What is the State of Marijuana in California?

Marijuana is legal in California for both medicinal and recreational use. Consequently, adults older than 21 years in the state can possess and consume marijuana without criminal or civil penalties, provided they are within the limits of the law.

The state first legalized medical marijuana on November 5, 1996, following the passage of Proposition 215 - The Compassionate Use Act. With a 56% popular vote on a statewide ballot initiative, this Act made California the first state in the United States to approve marijuana for medicinal use. Pursuant to this, Californians with qualifying conditions and state-licensed physician's recommendations can use, possess, and cultivate marijuana for the treatment of their debilitating medical conditions. The law also enables patients to designate personal caregivers, who could cultivate and purchase medical marijuana on their behalf and administer it when necessary. Public criticisms of the ambiguous nature of some of the wordings of Proposition 215 led to the passage of Senate Bill 420 in 2003. Senate Bill 420, or the Medical Marijuana Program Act, addressed the ambiguity in the previous Act cited by legalization proponents. The 2003 Act authorized patients and their caregivers to possess up to six mature plants or 12 immature plants and eight ounces of dried cannabis. It also established a patient identification system (medical marijuana cards) and authorized the formation of non-profit organizations to provide medical marijuana for patients.

The California Department of Public Health administers the Medical Marijuana Card Program via its Center for Health Statistics and Information. Even then, medical marijuana cards are issued and regulated at the county level. The law also allows counties to create and enforce local guidelines such as zoning restrictions on medical dispensaries and prohibition of outdoor cultivation.

Recreational marijuana was legalized in California in 2016, with the enactment of Proposition 64 -[

The Control, Regulate, and Tax Adult Use of Marijuana Act](https://leginfo.legislature.ca.gov/faces/billNavClient.xhtml?bill_id=201720180AB64). Proposition 64 passed with over 57% of the vote on November 8, 2016, effectively legalizing the use, sale, and cultivation of recreational marijuana in California. It allowed adults, 21 years and above, to legally:

- Possess, transport, process, purchase, and give away up to one ounce of usable marijuana or 8g of concentrate to adults 21 years and older

- Possess, plant, cultivate, harvest, and process up to six plants in a private residence, away from normal view and in compliance with local ordinances

- Smoke and ingest marijuana

- Possess, transport, purchase, and give away marijuana paraphernalia to adults 21 years and older

In 2017, the California Legislature passed Senate Bill 94, integrating the medical and recreational laws to create the Medicinal and Adult-Use Cannabis Regulation and Safety Act (MAUCRSA).

Eligible adults can purchase marijuana from any local dispensary in the state. Medical marijuana purchases will require the provision of valid medical marijuana cards or a doctor’s recommendation by the patients or caregivers. Recreational marijuana purchases will require the provision of valid photo IDs that establishes the buyers are of the legal age to purchase cannabis. It is illegal to obtain any quantity of marijuana from unlicensed dispensaries or illegal drug merchants. On a related note, there is no law exempting felons from using marijuana for medical and recreational purposes in California. However, it is recommended to confirm with the county program.

How Has Marijuana Affected the Economy of California?

As the sixth biggest economy in the world, the legalization of recreational marijuana in California is a huge social and economic experiment. The motive behind the state's marijuana laws is to keep cannabis out of children's hands and the profit out of the underground market. Since legalization, there are over 4,000 licensed weed stores and approximately $4 billion has been contributed to the California economy. Still, challenges remain. Below is a closer look of the economic impact of marijuana in the state.

Tax Revenue

The marijuana industry has significantly increased the amount of tax revenue generated in California. As with other businesses in California, licensed weed businesses in the state must pay the 7.25% sales tax. This includes a state sales tax rate (6%) and local rates (1.25%). Also, various district sales taxes may apply.

The California Department of Tax and Fee Administration (CDTFA) also levies a business-based tax known as excise tax on most forms of marijuana. This tax is set at 15% of the average market value of weed at retail.

Before entering the commercial market, the CDTFA also subjects a cultivation tax on cannabis. Typically, this tax is valued based on the type and weight of the marijuana. Cultivation tax applies to three forms of cannabis, including cannabis flower, cannabis leaves, and cannabis plants. This tax was due for inflation in January 2021. However, Assembly Bill 1872, a new legislation signed by Governor Newsom, allowed the cultivation tax rate for the 2021 fiscal year to remain unchanged from 2020. Effective January 1st, 2022, the new cultivation tax rate adjusted annually for inflation is as follows:

- Flower per dry-weight ounce - $10.08

- Leaves per dry-weight ounce - $3.00

- Fresh cannabis plant per ounce - $1.41

However, starting July 1st, 2022, Governor Gavin Newsom signed several bills into law to strengthen California cannabis laws, including the elimination of cultivation tax.

The CDTFA reported over $1 billion in sales and use tax for the 2020 Fiscal Year, with total sales exceeding $4 billion in the state. A breakdown of the tax revenue generated on California cannabis from 2018 to the end of the 3rd Quarter in 2023 include:

| Calendar Year | Excise Tax | Sales Tax | Cultivation Tax | Total Tax | Taxable Sales |

| 2018 (Q1) | $35,872,509 | $35,266,603 | $1,849,146 | $72,988,258 | $478,794,619 |

| 2018 (Q2) | $43,204,424 | $44,817,814 | $4,981,727 | $93,003,965 | $513,121,482 |

| 2018 (Q3) | $55,452,635 | $41,855,922 | $12,965,923 | $110,274,210 | $478,794,619 |

| 2018 (Q4) | $57,134,451 | $48,089,227 | $17,305,538 | $122,529,216 | $551,247,146 |

| 2019 (Q1) | $63,702,235 | $49,382,609 | $17,277,125 | $130,361,969 | $564,657,916 |

| 2019 (Q2) | $75,731,295 | $58,477,120 | $23,037,243 | $157,245,658 | $660,927,144 |

| 2019 (Q3) | $84,887,286 | $63,828,402 | $22,809,108 | $171,524,796 | $720,630,851 |

| 2019 (Q4) | $86,896,273 | $68,681,843 | $24,662,913 | $180,241,029 | $774,436,555 |

| 2020 (Q1) | $112,847,124 | $74,626,798 | $27,646,731 | $215,147,653 | $841,868,328 |

| 2020 (Q2) | $137,692,027 | $97,046,705 | $30,894,665 | $265,633,397 | $1,097,927,428 |

| 2020 (Q3) | $169,514,115 | $113,081,523 | $43,386,101 | $325,981,739 | $1,272,877,373 |

| 2020 (Q4) | $154,600,540 | $111,039,185 | $42,582,394 | $308,222,121 | $1,252,225,815 |

| 2021 (Q1) | $162,117,441 | $109,843,454 | $40,273,985 | $312,234,880 | $1,244,690,632 |

| 2021 (Q2) | $180,294,919 | $127,247,256 | $42,402,734 | $349,944,909 | $1,433,002,008 |

| 2021 (Q3) | $177,218,930 | $116,814,551 | $43,326,756 | $337,360,237 | $1,304,432,363 |

| 2021 (Q4) | $160,829,152 | $117,228,512 | $40,030,593 | $318,088,257 | $1,308,912,941 |

| 2022 (Q1) | $154,718,983 | $106,576,307 | $37,963,070 | $299,258,360 | $1,189,405,643 |

| 2022 (Q2) | $143,888,334 | $109,371,137 | $26,446,783 | $279,706,254 | $1,223,785,700 |

| 2022 (Q3) | $135,868,518 | $116,348,889 | $0 | $252,217,407 | $1,299,613,335 |

| 2022 (Q4) | $128,978,688 | $120,898,957 | $0 | $249,877,645 | $1,353,271,640 |

| 2023 (Q1) | $133,008,579 | $114,627,428 | $0 | $247,636,007 | $1,280,177,946 |

| 2023 (Q2) | $164,803,340 | $120,304,509 | $0 | $285,107,849 | $1,334,830,278 |

| 2023 (Q3) | $156,941,415 | $112,372,858 | $0 | $269,314,273 | $1,334,830,278 |

Impact on California Government Expenses

California cannabis tax revenue is deposited in the Marijuana Trust Fund and allocated as established by Proposition 64. Revenue in the fund is firstly used to pay back state agencies that incurred cannabis regulatory or administration costs not covered by license fees. Afterward, specific amounts are allocated to:

- Governor’s Office of Business and Economic Development: $10m - $50m is allocated yearly for the implementation of grant programs in communities disproportionately affected by previous drug policies.

- Public Universities in California: $10m is allocated yearly to conduct research and evaluate the effects of Proposition 64.

- California Highway Patrol (CHP): $3m is allocated to the CHP to support programs to reduce DUIs.

- University of California San Diego Center for Medical Cannabis: $2m is allocated yearly to study the risks and benefits of medical cannabis.

Of the remaining marijuana tax revenue:

- 60% is allocated to the Department of Health Care Services. The funds are designated to support youth anti-drug programs for substance abuse disorder education, prevention, and treatment.

- 20% is allocated to the Department of Fish and Wildlife and the Department of Parks and Recreation. The funds are designated to manage the environmental programs in the state that manage the damage caused by illegal marijuana cultivation.

- 20% to law enforcement - California Highway Patrol and Board of State and Community Corrections (BSCC). Funds allocated to the CHP are to support programs to reduce DUIs and create methods to determine if drivers are impaired. The funds allocated to the BSCC support programs to reduce the negative impacts on public health and safety from Proposition 64.

Income and Jobs

California is the biggest legal marijuana employer in the nation. There are over 83,000 Californians employed directly or indirectly from the cultivation, distribution, and sales of marijuana. Marijuana products sold in California are internally grown and this means jobs that could have been moved out of state for efficiency-sake remain in California.

Tourism

Although weed is still illegal at the federal level, its legalization for recreational purposes in California makes the state an appealing destination for tourists and visitors. Essentially, tourism positively affects the economy at both the government and private levels.

Crime Reduction

Marijuana-related crimes and arrests considerably dropped following the legalization of recreational marijuana. Possession of 1 ounce or less of marijuana had already been decriminalized before Proposition 64 made it legal to possess these quantities. This legalization caused a year-on-year decline in marijuana crimes.

What is the Marijuana Crime Rate in California?

Marijuana was legalized for recreational use in California in 2016 when Proposition 64 was passed. This made it legal for adults in California, 21 years and above, to possess one ounce of marijuana in public. The legalization of recreational marijuana in the state leads to a dramatic drop in marijuana-related crimes and arrests, according to a Department of Justice report.

In 2016, prior to legalization, there were 7,949 marijuana-related arrests in California, involving 7,254 adult and 695 juvenile offenders. After recreational marijuana was legalized, arrests for marijuana-related crimes dropped to 5,436 in 2018 and subsequently to 4,885, 3,985, 3,327, and 2,529 in 2019, 2020, 2022, and 2023 respectively.

What is the History of California Marijuana?

Marijuana was first cultivated in California in the 1850s and was primarily used for industrial hemp, ropes, and fibers. However, around the same time, particularly among the Hispanic immigrants from Mexico and South America. Following an influx of Mexican immigrants in the wake of the Mexican Revolution of 1910, opposition to the consumption of marijuana grew. This led to the amendment of the Poison Act of 1907 to include marijuana in 1913. The Poison Act was enacted to prohibit the use of opiates and cocaine without a prescription. The federal government made marijuana illegal, except for industrial and medicinal applications, in the United States with the 1937 Marihuana Tax Act. In 1970, the Marihuana Tax Act was repealed and replaced with the Controlled Substances Act. The Controlled Substances Act completely outlawed marijuana by labeling it a Schedule 1 drug, with no acceptable medical applications and a high potential for abuse.

In 1972, the California Marijuana Initiative (Proposition 19) failed to pass with over two-thirds of the votes cast at the ballot going against the measure. Proposition 19 had sought to decriminalize the possession and cultivation of marijuana by persons in the state that were 18 years and older.

By 1974 marijuana-related arrests in California had risen to 103,097 from 140 in 1935, costing the state over $100 million annually. A study commissioned by Senator George Moscone identified that 90% of marijuana arrests in California were for simple possession. Pressure from proponents led to the passage of Senate Bill 95, colloquially known as the Moscone Act. With the passage of the Moscone Act, possession of up to one ounce of marijuana was downgraded to a misdemeanor with a $100 maximum fine.

Medical marijuana was legalized in California in 1996 with the passage of Proposition 215. Proposition 215 legalized marijuana for medicinal use in California, making it the first state to allow marijuana use since 1937. Senate Bill 420 was enacted into law in 2003 to clarify the mandate and implementation of Proposition 215. This was occasioned by the vague wording of the provisions in Proposition 215. In 2010 Governor Schwarzenegger signed Senate Bill 1449 into law, expanding on the Moscone Act by further decriminalizing the possession of small quantities of marijuana. It reduced the charges for the possession of up to one ounce of marijuana from a misdemeanor to a civil infraction.

Proponents of legal marijuana introduced another ballot measure aimed at legalizing marijuana in 2010. Proposition 19 sought the legalization of recreational marijuana for adults 21 years and over but 53.5% of Californians voted against it. California again tried to legalize recreational marijuana in 2016, when Proposition 64 was put to the vote on November 8. The measure passed with 57% of the vote and enacted the Adult Use of Marijuana Act legalizing marijuana for recreational use in California. It also established the framework for licensing, regulation, and enforcement, with regards to recreational marijuana activity. To streamline the regulation of the marijuana industry (medicinal and recreational), Senate Bill 94 was passed in 2017. The Medical and Adult-Use Cannabis Regulation and Safety Act established the Department of Cannabis Control as the regulatory authority to control the California marijuana licensing industry.

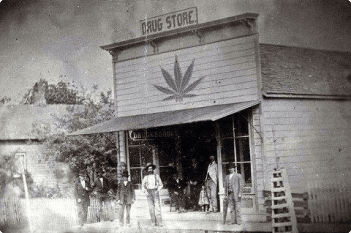

Cultivation of marijuana in the United States, the early 17th century.